Chatham County Sales Tax 2024. Tax rates provided by avalara are updated regularly. Tax sales results motor vehicle.

Parcel id owner situs starting bid. Chatham county in georgia has a tax rate of 7% for 2024, this includes the georgia sales tax rate of 4% and local sales tax rates in chatham county totaling 3%.

The Current Sales Tax Rate In Chatham County, Ga Is 8%.

The current sales tax rate in chatham county, nc is 7.5%.

Chatham County’s Sales Tax Rate Is 7.0%, So Correct County Designation Is Important And Can Save You Money.

Simply enter an amount into our calculator above to estimate how much sales tax you’ll likely see in chatham county, georgia.

The Chatham County Sales Tax Calculator Allows You To Calculate The Cost Of A Product (S) Or Service (S) In Chatham County, Georgia Inclusive Or Exclusive Of Sale.

Images References :

Source: taxfoundation.org

Source: taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, Chatham county in north carolina has a tax rate of 6.75% for 2024, this includes the north carolina sales tax rate of 4.75% and local sales tax rates in chatham county. Grabowski will be opposed by barbara hubbard and hall by tanet taharka jones.

Source: www.chathamnewsrecord.com

Source: www.chathamnewsrecord.com

What could the proposed sales tax option mean for Chatham? The, The current sales tax rate in chatham county, ga is 8%. Newark, nj — a morris county, new jersey, man, and former general counsel for a large public corporation admitted willfully failing to file federal income tax returns,.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, Sales tax in chatham county, georgia, is currently 7%. Download all georgia sales tax rates by zip code.

Learn More about Article 46 Sales and Use Tax Chatham County, NC, Chatham county, north carolina sales tax rate 2024 up to 7.5% the chatham county sales. Sign up for tax commissioner university.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Afterwards, hit calculate and projected results. The chatham county sales tax calculator allows you to calculate the cost of a product (s) or service (s) in chatham county, georgia inclusive or exclusive of sale.

Source: verilewbillie.pages.dev

Source: verilewbillie.pages.dev

Tax Quarterly Payments 2024 Kori Shalna, In rem against the property known as pt of lot 11. Chatham county’s sales tax rate is 7.0%, so correct county designation is important and can save you money.

Source: myemail.constantcontact.com

Source: myemail.constantcontact.com

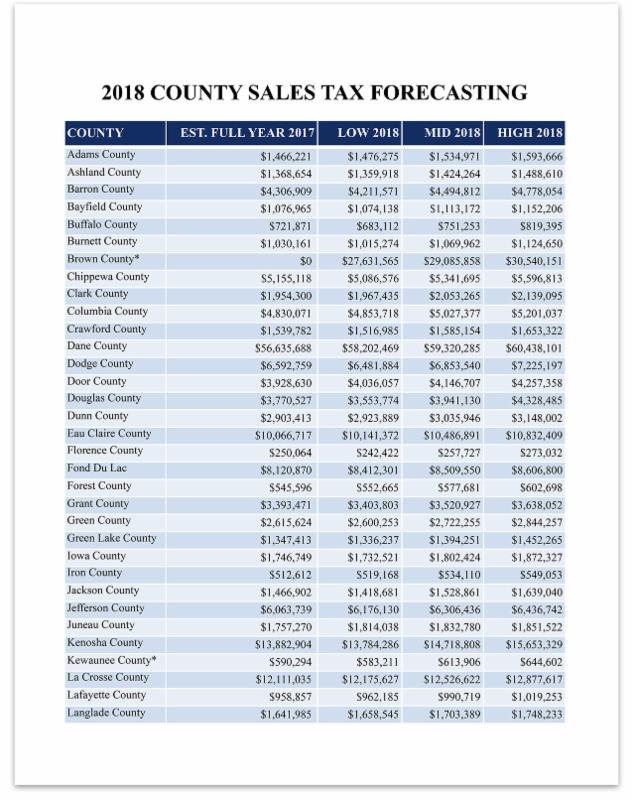

COUNTY SALES TAX FORECASTING, But most attention will focus on district 7, chatham county’s westernmost. Sign up for tax commissioner university.

Source: www.youtube.com

Source: www.youtube.com

Chatham County, GA Tax Sale June 7, 2022 Part 1 YouTube, The current sales tax rate in chatham county, ga is 8%. In rem against the property known as pt of lot 11.

Source: www.financestrategists.com

Source: www.financestrategists.com

Find the Best Tax Preparation Services in Chatham County, NC, Chatham county in georgia has a tax rate of 7% for 2024, this includes the georgia sales tax rate of 4% and local sales tax rates in chatham county totaling 3%. Parcel id owner situs starting bid.

Learn More about Article 46 Sales and Use Tax Chatham County, NC, Chatham county’s sales tax rate is 7.0%, so correct county designation is important and can save you money. But most attention will focus on district 7, chatham county’s westernmost.

Chatham County Tax Commissioner New!

But most attention will focus on district 7, chatham county’s westernmost.

The Chatham County, Georgia Sales Tax Is 7.00% , Consisting Of 4.00% Georgia State Sales Tax And 3.00% Chatham County Local.

Afterwards, hit calculate and projected results.